On Building Machines That Understands Why

Estimand has declared war on LLMs. “ChatGPT and similar systems are exciting moves forward, but they do not explain the critical why,” explains Todd Moses, CEO of Estimand.

Estimand has declared war on LLMs. “ChatGPT and similar systems are exciting moves forward, but they do not explain the critical why,” explains Todd Moses, CEO of Estimand. Turing Award winner Judea Pearl agrees. He describes LLMs as intelligence without a model of reality.

An LLM can determine the next word to include in a sentence, but it does not understand what the sentence means. The causal AI developed by Estimand is much closer to having this context. As Estimand’s AI discovers the cause of events, it builds the story of why each event occurred. “This is the foundation for Artificial General Intelligence (AGI),” declares co-founder Todd Moses.

Knowing the Unanticipated

Estimand’s first use case for causal AI is financial risk. By training on economic, geopolitical, environmental, social, and technology datasets, Estimand’s causal AI reveals the risk factors that influence financial events.

“We started with the simple question of what influences house prices. However, the answer surprised us.”

“We started with the simple question of what influences house prices. However, the answer surprised us.” says Moses. It turns out that if you are interested in the contributing factors that drive price, you must look across time. An important driver of home prices today goes back to the number of precipitation days from 20 years ago.

“While understanding the drivers of price is important, Estimand believes it has an opportunity to revolutionize insurance.” describes Moses. Currently, insurers are very good at calculating risk. However, the problem with these statistical methods is that they do not discover the unanticipated. This is what Estimand’s AI does.

Applications

“Unlike LLMs, Estimand’s output is a graph of relationships,” describes Moses. This structure represents how multiple factors are related. Machines could use it to provide context, but for now, it focuses on answering human questions. For example, what parameters represent the most significant causes of the insured event?

“Unlike LLMs, Estimand’s output is a graph of relationships”

When the unanticipated becomes known, it changes how the world works. Underwriters, asset managers, and executives no longer need to worry about what they do not know. Instead, they can focus on mitigating the danger from what was previously unknown.

How it Works

Estimand’s AI is trained on thousands of time series datasets and updated regularly with the latest versions. It uses causal detection methods to determine how each dataset relates to the others provided. Users then provide their datasets to realize how what is most important to them relates to global events.

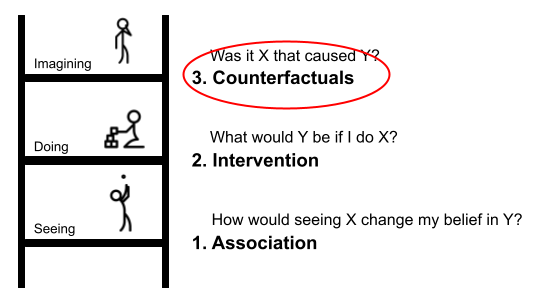

“Our work in causal detection is founded on counterfactual or what-if experiments,” explains Moses. Once the AI determines a likely causal relationship, it performs a series of tests to verify it. These began with a Tree-Augmented Naive Bayes (TAN) model and then filtered into matrix experiments that determine the relationship.

As causal relations are proven, the AI calculates the significance of those relationships with the direction. For example, do ocean temperatures influence the hurricane or does the hurricane influence ocean temperatures, and if so, by how much?

About Estimand

Founded in April 2023, Estimand Inc. is a Delaware Corporation with principal offices in Raleigh, North Carolina. We began as a paper on causal AI that evolved into the first company to instantly reveal the factors behind global financial risk. You can learn more about Estimand by visiting our website: https://estimand.ai.